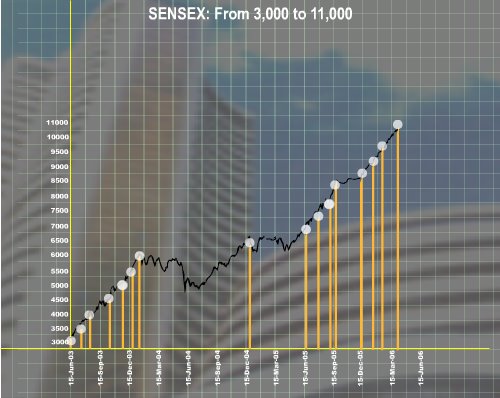

Sensex Touches 11000 Mark

The Bombay Stock Exchange benchmark Sensex on Tuesday reached the 11,000 milestone and also touched an all-time high of 11,017.25 on sustained buying by funds, but lost some ground to close at 10,905.20.

Positive budget proposals, the Supreme Court's judgement on selling of mill land, robust economic growth, expectations of higher than eight per cent GDP growth and last but not the least, first roadmap to be announced by RBI on capital account convertibility by July end this year, cleared the decks for the Sensex to cross the 11,000-mark, dealers said.

The BSE-30 share sensitive index opened slightly better at 10,945.62 against Monday's close of 10,941.11 and later shot up to the new intra-trade high of 11,017.25. Thereafter, the market turned volatile on alternate bouts of buying and selling during the last hour with profit taking pushing the index to a low of 10,863.61. Later, it closed at 10,905.20. IT shares, which were the favourite with investors on Monday, ran out of steam and some of them finished with losses.

The Sensex took 33 trading sessions to cross over the 11,000 mark after it had crossed the 10,000 mark on February 6.

The Sensex took 33 trading sessions to cross over the 11,000 mark after it had crossed the 10,000 mark on February 6.

By hitting the 11,000 mark, the BSE Sensex has joined the exclusive club of leading world market indices like the Dow Jones (USA), Nikkei (Japan) and Hang Seng (Hong Kong) that trade above the 11,000 mark.